8 COLUMN WORKSHEET OR WORKSHIT?

- Jan 18, 2017

- 4 min read

8 COLUMN WORKSHEET OR WORK SHIT?

According to the accountingexplanation.com, "A work sheet is a large columnar sheet of paper, especially designed to arrange in a convenient systematic form all the accounting data required at the end of the period. The work sheet is not a part of the permanent accounting record but it is a working paper of accountants, prepared by pencil. If an error is made on the work sheet, it may be erased an corrected much more easily than an error on the formal accounting records. The work sheet is designed in a manner that it minimizes the chances of errors to the maximum possible extent. It brings into light many types of discrepancies which otherwise might be entered in the journal and posted to the ledger accounts.

Reference:

Retrieved from http://www.accountingexplanation.com/work_sheet.htm

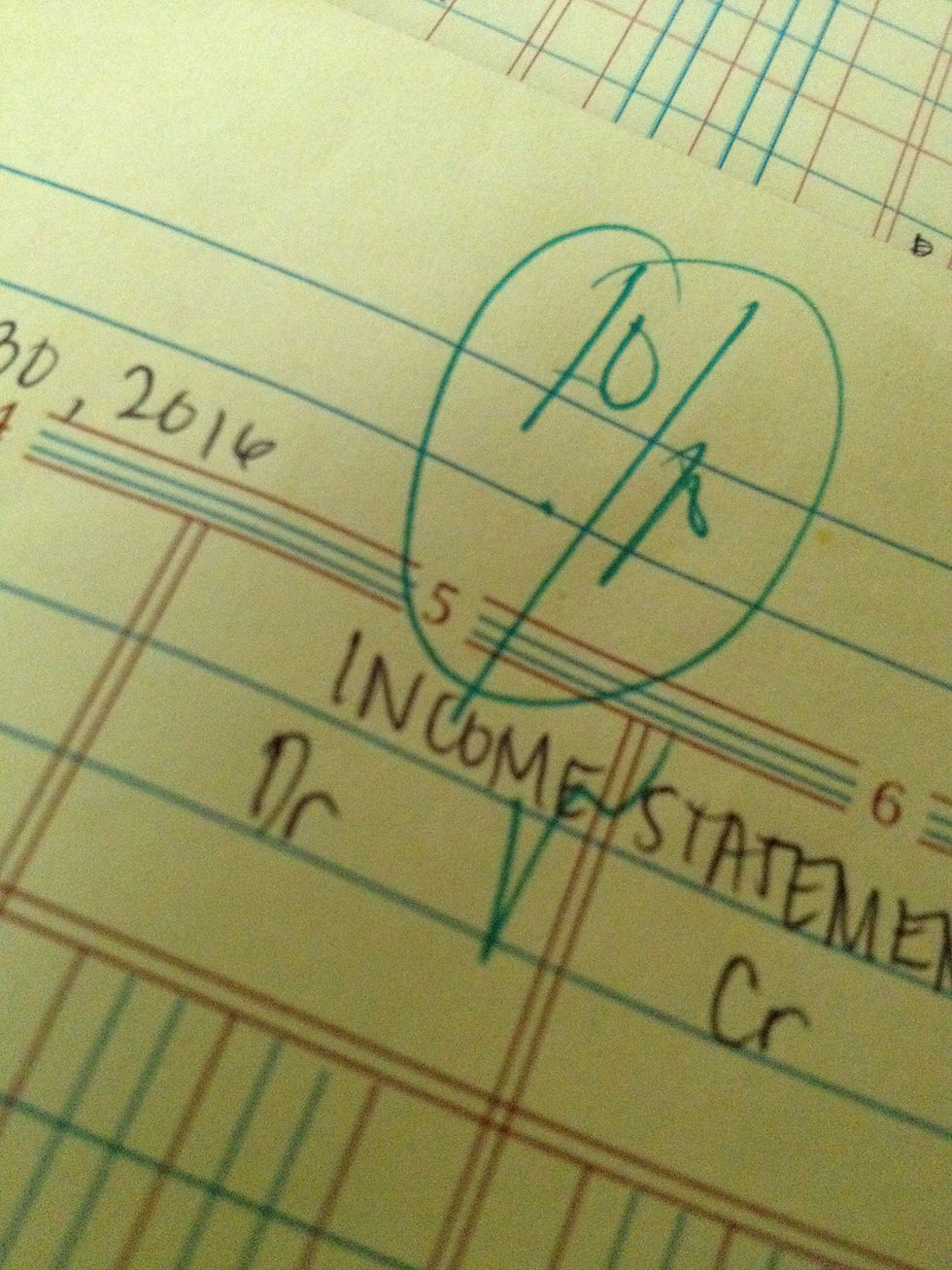

This is one of my worksheets in the 3rd quarter. It was an assignment which was based on our performance task last 2nd quarter. I find it very hard in the first place because it was 8 columns and the digits are very small and account titles are too many.

The 8-column worksheet is composed of 8 columns:

1st column & 2nd column – debit and credit column of the Trial Balance

3rd column & 4th column – debit and credit column of the Cost of Sales

5th column & 6th column – debit and credit column of the Income Statement

7th column & 8th column – debit and credit column of the Balance Sheet

THINGS THAT I NEED TO REMEMBER WHEN DOING AN 8-COLUMN WORKSHEET

1. Trial balance should be accurate.

2. Write the heading. e.g.

3. The arrangement of the account titles will always be based from the Chart of Accounts. According to unknown (which wishes to be unknown), cash is the most liquid asset that’s why it comes first.

4. Write the values aligned with the account titles.

5. Trial balance is composed of assets, liabilities, and owner’s equity. Note: You should place the value of the account titles in their proper places for it to be balanced. e.g.

6. Cost of sales is composed of merchandise inventory beginning, purchase and purchase related accounts, freight in, and merchandise inventory ending which is credited to be deducted to the merchandise inventory beginning. e.g

7. Income statement is composed of sales and sales related accounts, operating expenses and the value of cost of sales. e.g.

8. The balance sheet is composed of assets excluding the merchandise inventory beginning, liabilities, capital and drawing of the owner, and merchandise inventory ending. e.g.

9. See to it that the net income of income statement and balance sheet are the same to know that it is correct.

10. In determining the net income if it’s net profit or net loss:

Net profit – if the difference of the income statement and balance sheet is located in the debit of the income statement and credit of the balance sheet

Net loss – if the difference of the income statement and balance sheet is located in the credit of the income statement and debit of the balance sheet

I chose this worksheet of mine which I scored 10/10. It is because this worksheet truly seen how I’ve struggled in doing the task. I keep on being careful to avoid errors and to refrain myself from repeating but still, I repeated many times. This also became the start of my learning in this 8-column worksheet. I got to know the steps on how I will do the task. In this first worksheet is where I learned first.

P.S. I am the one who made the THINGS TO REMEMBER.

Still confused?

When preparing financial statements, the accountant must ensure that:

1. All accounts are brought up to date 2. All late transactions are taken into account 3. All calculations have been made correctly 4. All GAAP's have been complied with The accounting entries produced by the process known as Adjusting Entries

Nominal Accounts

Have balances that are reset to zero at the end of each fiscal period Ex. Drawings, revenue, expenses, and income summary account

Real Accounts

Have balances that continue into the next fiscal period Ex. Assets, liabilities, capital

Closing Entries Definition

Are made to reset the nominal accounts in preparation for the start of the new fiscal period

Fiscal Periods

-the accounting cycle involves a series of steps that are repeated for each accounting period -the periods vary from firm to firm -they can be monthly, quarterly, semi-annually, or yearly

Accounting Cycle

1. Business Transactions 2. Source Documents 3. Journal Entries 4. Post to Ledger 5. Trial Balance 6. Worksheet

Worksheet

An informal business paper used to organize and plan information for financial statements

Preparing the Worksheet

1. Enter heading, indicate fiscal period 2. Enter, totals, rule the trial balance 3. Copy balance sheet amounts in Dr or Cr column of balance sheet; A, L, OE 4. Copy income statement amounts to income statement column; Revenue, Expenses, Loss/Gain 5. Rule and total last 4 columns, they will NOT equal 6. Income Stmt. total revenue - total expenses = net income in Dr column. Balance Sheet, total assets - total liabilities = amount in Cr column. Record net income in the outer two of the last four columns 7. Total and Rule the worksheet

Net Loss Situation

On worksheet - total would be in Cr column of income statement, and in Dr column of balance sheet

Statement Presentation

Income Statement- depreciation expense Balance Sheet- accumulated depreciation

Reference:

Accounting- Chapter 8 (Adjustments and The 8 Column Worksheet).

Retrieved from https://quizlet.com/140155087/accounting-chapter-8-

adjustments-and-the-8-column-worksheet-flash-cards/

Comments